Source: name placeholder

Status: #🛈/📖/♻️

I - System structure and behavior

1 - The Basics

- what makes the slinky bounce? it's not the hand, the hand just releases a latent behavior

- a system is a set of things that are connected which start producing their own patterns of behavior over time

- system responds to the outside forces in a way which is characteristic for itself

- system to a large extent causes a behavior - same external factors appillied to other systems produce different results

- we have intuitive understanding of systems but we take them for granted, often thinking that external factors are causes of problems

- many concepts in system theory pull from intuitive public knowledge, and lessons from system theory often have pretty similar people-sayings i.e. one stitch saves nine, don't put all eggs in one basket

- many solutions to external problems have been solved by looking outside, but some issues eg poverty hunger war keep being unsolved because they are systems problems, they come from inside, and can only be handled by intuitively understanding the system and restructuring it

- systems thinking is not better than reductionist thinking, it's complementary as it gives you a fuller picture (microscope+eye+telescope)

- you can't know behavior of systems just by knowing the parts that make them up

- interconnections hold system's elements together. In most systems, they operate through flow of information, or physical flow in some systems (e.g. flow of water through roots in a tree)

- some flows are easier to see (flow of students through university), while some are harder (informal information and communication between students that makes them take classes that are easier to pass)

- in addition to interconnections, each system has a function or a purpose - which is only legitimately communicated through behavior of a system (e.g. a government might say it cares about pollution, but dedicate little resources to solving that problem, showing that it's obviously not it's purpose, even though they explicitly say it is)

- function is usually used for non-human systems, and purpose for human ones

- important function of every system is to ensure its own perpetuation

- systems have subsystems with their own subpurposes

- purposes don't have to be desired or intentional, but they can arise out of purposes of smaller components of a system - no one wants drug addicted crime ridden society, but some people are desperate for psychological relief, some want to earn money, pushers are less bound by law then police, governments make substances illegal and use force, people more interested in protecting themselves then in recovery of addicts

- keeping subpurposes and purposes in harmony is a property of most successful systems

- bases on above, we can say that systems consist of their elements, interconnections and purposes

- change in purpose has the biggest impact, while changing elements mostly has no impact on the system

- stock of a system represents it's elements that can be counted or measured: water in a bathtub, population of a country, books in a bookstore, hope that world can be a better place…

- flows are processes through which stock changes over time: flowing and draining, births and deaths…

- underground mineral deposit is a stock, out of which comes a flow of minerals into another system. minerals also flow in, but it takes a ridiculously long time

- example of multiple flows affecting a stock is that water reservoir has inflow of water through rain and river, and outflow through evaporation and discharge

- dynamic equilibrium is when the stock doesn't change, but flows continually bring stock up and reduce it in the same amounts - you can stop the water level going down in a bathtub by both closing the sink and by opening the faucet

- human mind finds it easier to notice stocks than flows, and easier to notice inflows than outflows

- it's more intuitive that you can make oli last longer by finding a new deposit, than it is that you can do it by burning less oil

- company can raise number of employees by either hiring more or increasing retention of existing employees - two strategies with a vastly different costs

- stocks take time to change because flows take time to flow

- this is why stocks can act as delays, buffers and shock absorbers in a system

- even if government has a lot of money, it can't make hundreds of factories overnight - it takes time to accumulate the amount of factories that burn fossil fuels

- when government decides to switch to a more sustainable fuel, it can't make the change in all factories at once

- once the change is made, the amount of CO2 will fall and ozone layer will repair, but it took decades to get this bad, and it will take decades to get better

- these time lags can cause problems, but can also be a source of stability in a system

- being aware of rate of stock change can help you not give up too soon, give you room for experimentation, give you a chance to use opportunities presented by systems momentum

- stocks decouple inflows and outflows and allow them to be out of balance

- feedback loops

- systems thinkers see the world as a collection of stocks and mechanisms for regulating stocks by manipulating their flows - in other words, collection of feedback processes

- if you see a pattern in stock (growing, shrinking, staying the same) that is consistent over time, there is likely a mechanism creating this consistent behavior

- these mechanisms operate through feedback loops

- first hint of existence of feedback loops is having consistent behaviors over long periods of time

- feedback loop is formed when changes in a stock affect the flows of a stock

- simplest one being interest rate for savings, the more money you have in account, the bigger the inflow because it's based on percentage

- another one is when a person sees a low balance of money and decides to work longer hours to increase its inflows

- if there is a lot of money in your account, you might feel a need to work less and earn less

- these kind of feedback loops are in place to keep the stock of money inside your account in levels that are acceptable to you

- again it's important to remember that modifying inflows is not the only way to change your stock of cash, same can be achieved through outflows, by changing how much you spend

- not all systems need to have feedback loops, but ones that do are common, elegant and surprising

- for example, stock that changes flows based on outside factors that don't depend on their stock are not feedback loops

- stabilizing loops - balancing feedback

- example of person earning more or less to keep their bank balance in desired levels is a balancing, goal-seeking feedback loop

- another example is drinking more coffee to raise energy, and taking less once you are full

- these feedback loops operate in both directions to keep stock in desired balance

- another example is cup of coffee cooling (or heating up if iced) to match room temperature - it seeks balance

- these feedback loops offer stability and resistance to change to the system

- feedback loops don't need to be effective

- the signal might be too weak, unclear, incomplete, arrive at the wrong place or wrong time

- in this case the goal of the feedback loop will never be reached by the stock

- runaway loops - reinforcing feedback

- reinforcing feedback loops are amplifying, self multiplying and keep pushing in one direction, whether it's bad or good for the system

- they enhance whatever direction of change is imposed on the system

- examples

- the more prices go up, the more wages need to go up to maintain the standard of living - the more wages go up, the more prices go up to maintain profitability, which in turn makes the prices go up again

- the more soil erodes, the less plants can grow, and the more soil is eroded because there is less roots

- the more you practice an instrument, the more pleasure you get from the sound, making you spend more time playing and getting more practice

- these loops happen where a system element is able to reproduce itself or grow as a constant fraction of itself

- being self enhancing means that they lead to exponential growth or runaway collapses over time

- the more you think about which decisions are not impacted by feedback loops (decisions made without regard for the stock of the system), the more you will see feedback loops popping up all around you

- math time: the time it takes for exponentially growing stock to double in size is approximately

70/growth rate- $100 with 7% interest per year will double the money in 10 years (70/7=10)

- if you hear that population growth causes poverty, is it possible that poverty also causes population growth? if A causes B, is it possible that B also causes A?

- system thinking shifts the question from who's to blame to what's the system, as feedbacks open up the opportunity for systems to cause their own behavior

- examples above are limited to one kind of feedback loop at a time - this is rarely the case in reality as loops are often linked together in complex patterns pulling the stock in several directions - a single flow may be modified by a content of 20 stocks

- because of this, complex systems tend to do much more than stay steady, explode exponentially or self-correct smoothly

2 - a brief visit to the system zoo

- systems zoo is similar to normal zoo, we look at categorized, isolated systems and describe them to better understand their behavior and some of the mechanisms that make them tick, while acknowledging that they are still isolated from their normal environment where they would have many complex interactions

- for now we care about systems on their own, and ignore ecosystems

- there is a separate set of books describing different systems in this manner

One stock systems

One stock, two balancing loops

- example of this is thermostat controlling heating system

- based on thermostat setting, we have a balancing loop that adds heat if there is discrepancy between desired and actual room temperature (heat from furnace flows in)

- based on outside temperature, we have a balancing loop which removes heat to the outside based on discrepancy between room temperature and outside temperature

- important thing to notice is that changing the desired temperature doesn't instantly work, there is a period where we asked for a bigger temperature, but the temperature is still falling down until the furnace heats up

- another example of this is a shop having to order stuff up front before they run out, or they won't have stuff to sell because of the delay

- this gives us two behaviors, one general and one specific to thermostat

- general: the information delivered by feedback loop can only affect future behavior, it can't have fast enough impact to correct the behavior that drove the current feedback

- decision maker in the system that is making decision based on feedback can't change the behavior that drove the current feedback, the decision made can only affect the future behavior

- this means that there will always be delay in responding - this is because flow can't directly react to a flow, it can only react to change in the stock, and only after a slight delay it takes to register the incoming information

- this difference in time is a reason many economies don't behave like economic models that try to predict them

- specific: in thermostat like systems you must remember whatever draining/filling processes are going on:

- if you want to keep temperature at 25, you need to set it above 25 to account for the cooling until heating kicks in

- if you are hiring to hit the target, you need to hire more to account for people who leave while you are hiring

- general: the information delivered by feedback loop can only affect future behavior, it can't have fast enough impact to correct the behavior that drove the current feedback

- keep in mind that every balancing loop has its breakdown point, where other loops pull the stock away from its goal more strongly than it can pull back (e.g. too low power furnace and too cold outside)

one stock, one reinforcing and one balancing loop

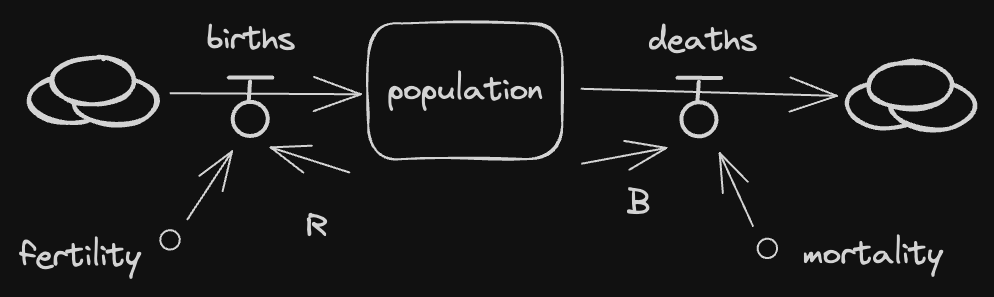

- example of this is population and industrial economy - applies to any living population and any economy

- reinforcing loop causes population to rise through birth rate, and a balancing loop causes it to die off through death rate

- if fertility and mortality rate are constant (which they'd rarely be in real-life systems), the system would either grow exponentially or die off depending on which loop is stronger

- changing fertility and mortality change the behavior over time creating bends in the stock graph

- e.g. if fertility rate slowly falls down over time to equal mortality rate, the two would slowly come into balance and the stock would become constant

- this is an example of shifting dominance in feedback loops

- when a loop dominates another, it has a stronger impact on behavior

- in systems that have multiple competing loops, the dominating loops will determine the behavior

- at first fertility is higher than mortailty, creating exponential growth as the reinforcing loop dominates

- the loop is gradually weakened as fertility falls, to the point when they are equal and neither loop dominates, which creates a dynamic equilibrium

- complex behaviors of systems often arise as the relative strengths of feedback loops shift, causing first one loop and then another to dominate the behavior

- there are only a couple possible behaviors of such systems:

- reinforcing loop dominates, so the stock grows exponentially

- if the balancing loop dominates, the stock will die off

- if both loops are equal in strength, the stock will level off

- it can do a sequence of above things as relative strengths of the loops change over time

- there are some questions you can ask yourself when you want to determine how good is a model for representing reality:

- are driving factors likely to unfold this way (what are birth and death rate likely to do?)

- cant be answered factually, its a prediction of future

- you can have a strong feeling about it but there is no way to prove

- system analysis can make test about what happens when driving factors do different things

- dynamic system studies are not designed to predict what will happen, but what would happen if a number of driving factors unfold in a number of different ways

- if they did unfold that way, would the system react this way (would stock really exponentially grow/level out/die off)

- this is a more scientific question, about how good the model actually is

- this is regardless of whether the driving factors would likely do that, we are just concerned with whether the system would behave that way if they did

- in example above, its roughly true, but the model could be more detailed e.g. by including age groups

- what is driving the driving factors (what affects the birth rate? what affects the death rate?)

- this is a question about system boundaries

- are the driving factors independent or are they embedded into the system?

- does the size of the system feed into fertility and mortality in any way?

- do economic/social/environment factors affect fertility/mortality?

- does the size of population affect economic/social/environment factors?

- all of this is true, because this "animal" is only a part of a larger system

- are driving factors likely to unfold this way (what are birth and death rate likely to do?)

- reinforcing loop causes population to rise through birth rate, and a balancing loop causes it to die off through death rate

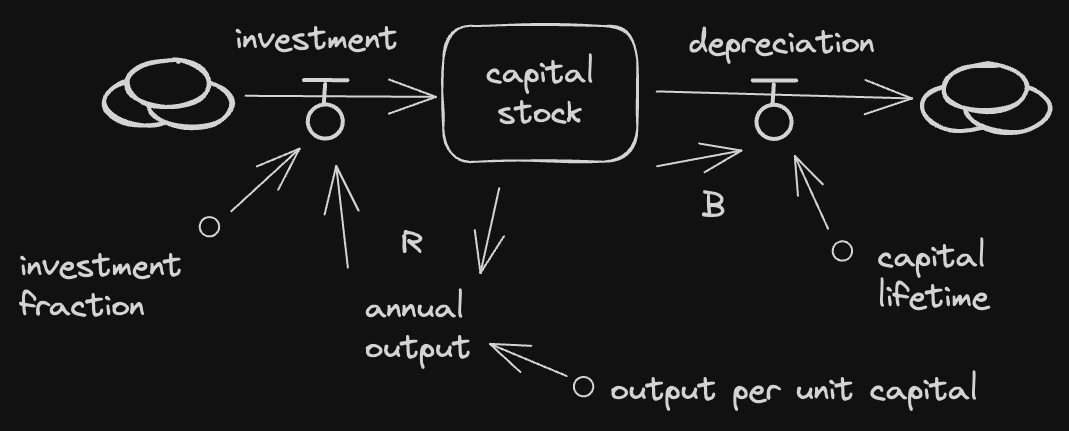

- the system above is influenced by economic system, which is similarily a stock with reinforcing and balancing loop as well

- the greater the stock of physical capital (machines and factories), the more output can be produced - the more output is produced, the more capital can be made

- similar to fertility, the greater fraction of output the society invests, the faster capital stock will grow

- the physical capital is drained by depreciation, obsolence and wearing out

- balancing loop controlling depreciation is similar to mortality balancing loop

- the "mortality" of capital depends on average capital lifetime - the longer the lifetime, the smaller fraction of capital needs to be retired each year

- the greater the stock of physical capital (machines and factories), the more output can be produced - the more output is produced, the more capital can be made

- since the structure is the same, we expect to also see the same behaviors as in the system above

- as reinforcing loop dominated for population, so it did for economy as well, and over the last 10s of years it grew exponentially

- we also don't know which lop will dominate in the future, and whether capital will continue growing, stay the same or die off

- this depends on

- investment fraction (how much of what's earned is invested)

- efficiency (how much capital is required per unit of output)

- capital lifetime (how long before capital stops producing output)

- if investment fraction and efficiency are constant, the value of capital lifetime will determine whether the stock grows exponentially (e.g. 20 year lifetime), stays in dynamic equlibrium (e.g. 15 year lifetime) or dies off (e.g. 10 year lifetime)

- one more example of how we can increase stock not only by having more inputs, but of having less outputs!

- as there are many things influencing the population system (economic system included), so do many things influence economic system (population system included)

- these two should always be portrayed together to give a better picture because

- the richer the country, the better the healthcare and the lower the death rate

- but also, the richer the country, the lower the birth rate

- important thing for economic development is that reinforcing loop of capital grows faster than reinforcing loop of population growth, so that population is getting richer instead of poorer

- while it may sound strange that these two systems are similar enough to be considered the same "zoo animal" (factories/production and babies being born and people dying), but what makes them similar is their feedback loop structures - they both have:

- reinforcing growth loop (reproducing themselves out of themselves)

- balancing death loop

- aging process (steel mills age and die off just like people)

- systems with similar feedback structures will produce similar dynamic behavior

a system with delays - business inventory

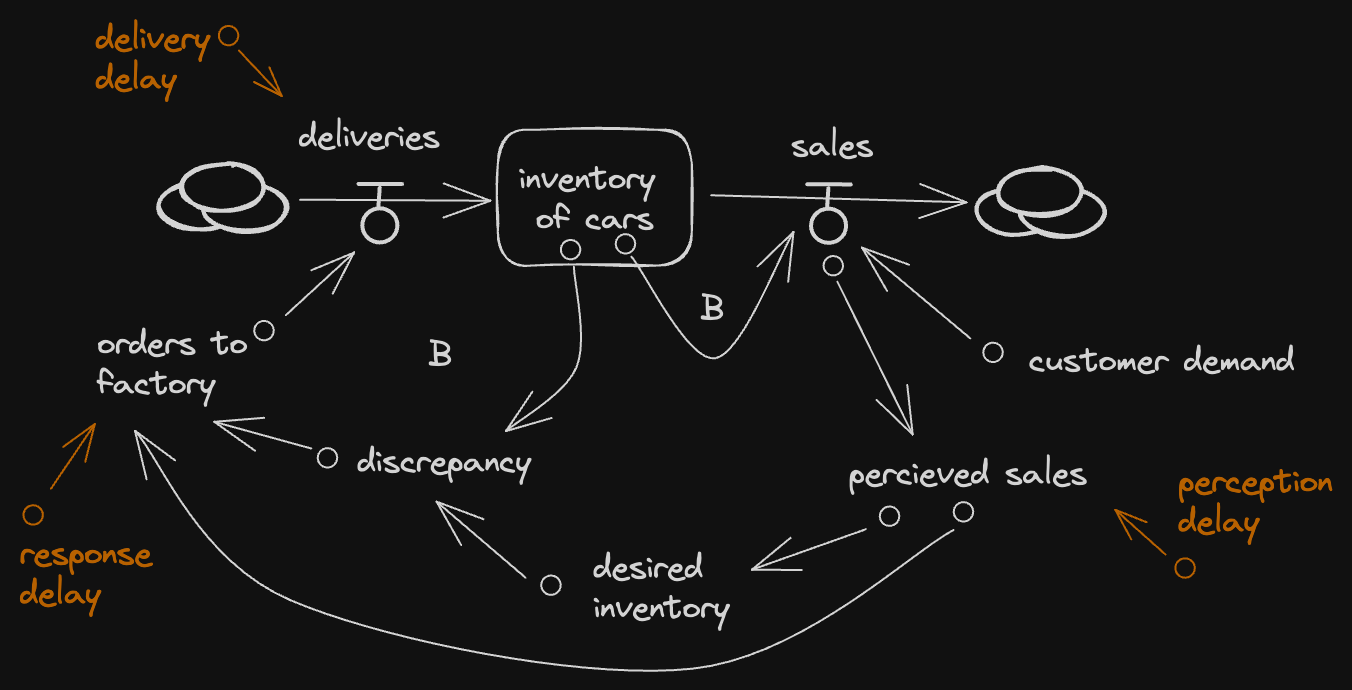

- lets picture a car dealership, a system with inflow of deliveries from factories, and outflow of car sales

- the dealership tries to balance the amount of cars they have on the lot, because the amount of deliveries and sales can't match up every day - they need to have some cars in stock, and order again when they see the stock decreasing so that they don't run out of cars to sell

- they also need to be mindful of late deliveries and have some extra stock to compensate for that

- they also need to monitor sales (perceived sales) so that if they seem to be rising, they can order more cars to compensate for that

- higher sales -> higher perceived sales -> higher discrepancy between current inventory and desired inventory -> bigger orders -> more deliveries -> increase in inventory

- this system would be similar to thermostat system, one balancing loop keeping enough cars on the lot, and another one draining the inventory stock

- if this system behaved the same as the thermostat system, and we had a permanent increase in sales of 10%, the amount of cars in the lot would increase by 10% and that would be it

- however this system behaves totally differently, and the reason for it is that it has delays

- these delays (in yellow) are similar to what we'd expect to see in the real world:

- perception delay is intentional in this case, car dealer doesn't want to react to any blip in sales that happens - instead they'd average the sales over five days to see if any real trends are starting to pop up

- response delay is also intentional - instead of ordering the whole batch at once, car dealer can make the desired order over 3 days - 1/3 of order each day

- when delays are introduced into a balancing feedback loop, system starts to oscilate

- in this example:

- initial step up causes inventory to drop

- car dealer watches to see if the change is consistent before ordering more, and there is a delay before the shipment arrives

- during this time, inventory drops more, so more orders are needed to maintain the stock

- once the shipments start to arrive, inventory recovers, and more than recovers (because a lot was ordered during the time of uncertainty)

- once mistake is noticed, car dealer starts ordering less, but old orders are still arriving

- because of uncertainty of what's to happen next, it's almost inevitable that car dealer will start ordering too little, leading to inventory to drop again, creating the oscilation

- another example is when using hot/cold water mixer when the pipes are long, you try to get a bit hotter water, the water then becomes too hot, you try to reduce the heat a bit, but it becomes too cold

- in this example:

- it's important to know that this is not a car dealer skill issue, this is a problem of working with a system in which you can't have timely information, and where the system doesn't immediately react to your actions

- you don't know what your customer will do, and once they do it, you don't know whether they'll keep doing it

- this type of issue is common in inventory systems, and many other systems, but predicting how oscillations will act is no simple matter

- lets see what can car dealer do about it, because "this is intolerable":

- since this happens because of delays, they can't do anything about delays from the factory, but they can reduce their time to act, e.g. by not averaging sales over 5 days but over 2 days

- turns out that doing this doesn't change much, and might even make the oscilations worse

- what if instead of changing perception delay, car dealer changes response delay, and orders the whole batch over two days instead of three?

- things get much worse in this case

- since this happens because of delays, they can't do anything about delays from the factory, but they can reduce their time to act, e.g. by not averaging sales over 5 days but over 2 days

- something has to change, and since car dealer is a learning system, something will change

- the above is a good example of how someone tries to fix an unintuitive system, and ends up making things worse

- intuitive part is that you should reach for changing the delays you are in control of as it's obvious that that's the lever that has strong influence on the system, but the unintuitive part is that instead of speeding delays up, you should be slowing them down even further

- the problem above is not that the dealer was reacting too slow, but too quickly

- if instead of speeding up their response delay from 3 days to 2, they end up slowing it down to 6 days instead, oscillations are damped and the system finds equilibrium quite quickly

- delays are strong determinants of behaviors of systems which have them

- changing the delay might make a large change in behavior of a system, and make the system much easier or harder to manage

- the car dealership system affects other systems - car production, industries it depends on, number of jobs, the ability to buy cars and back to car dealership, making this a big reinforcing loop

- this large system of different industries responding to each other through delays is the cause of business cycles

- economy is full of such balancing feedback loops with delays, which are by their nature oscillatory

two-stock systems

- renewable stick constrained by non-renewable stock (oil industry)

- systems we've seen so far were free if constraints (production didn't consume resources, population didn't have to eat)

- any growing physical system will eventually meet constraints which will act as a balancing loop that shifts the balance of reinforcing loop by either strengthening the otflow or weakening the inflow

- the growing system facing limits is so common it's an archetype in systems thinking called limits-to-growth

- when we see a system that's growing (population, corporation, bank account, rumor), we always look for a reinforcing loop that drives it, and a balancing loop that will ultimately constrain it

- even if balancing loop is not apparent, we logically know it's there because no physical system can grow forever in a finite environment

- like resource constraints that limit supply inflow, there exists a pollution constraint, which can be renewable or non-renewable

- non renewable is when environment can't absorb the pollutant and make it harmless

- renewable is when environment has the capacity to remove the pollutants

- everything said about resource constrained systems applies to pollutant constrained systems too, but in a opposite direction

- limits can be temporary or permanent, but eventually system needs to adjust to the constraint, or the constraint needs to adjust to the system, or both to each other

- capital system that makes money by extracting a non renewable resource (oil company)

- more capital more investment, higher extraction rate

- higher extraction rate, lower the resource stock

- lower stock means lower yield, so lower profit

- oil reserve could support 200 years of extraction with starting rate, but if extraction rate grows 5% per year it will double in 14 years

- after 28 years capital stock has quadrupled, but extraction starts to lag

- after 50 years, cost of extraction is higher than yield so the operation shuts down, and the last amount of unextracted oil stays in the ground

- since doubling happens every 14 years, if there were double the amount of oil in the ground, it would take 14 more years to deplete - if the amount of oil quadrupled, that's just 28 more years

- whenever something grows exponentially towards a limit, it will reach it in surprisingly short time

- if you want to make most money in as little time, then the most important factor is amount of resources, but if you are a miner concerned with longevity of their job, you also care about desired growth rate of capital - it's a choice of getting rich very fast, and get less rich but maintain the operation longer

- the bigger percent of profit reinvested, the faster peak is reached

- capital system that makes money by extracting a non renewable resource (oil company)

- what if price is not constant?

- if demand stays even if price rises because of scarcity, it will mean more profits, more capital and more motivation for more costly resources to be extracted

- the capital rises higher before it collapses

- same would happen if prices don't go up but technology makes costs of extraction lower

- if demand stays even if price rises because of scarcity, it will mean more profits, more capital and more motivation for more costly resources to be extracted

- this happens when resources deplete locally, will the same thing happen globally?

- in these systems peak is always followed by crash, and that could happen to our economy if we don't focus on using renewable sources

renewable stock constrained by a renewable stock - a fishing economy

- non-renewable resources are stock limited, their lifespan depends on the speed of extraction

- renewable resources are flow limited, they can be extracted forever, as long as it's not faster than they regenerate